There are several key benefits from investing early versus waiting, such as compound interest, time and risk, and experience.

The Advantages of Saving and Investing Early

By:May 31, 2017

For many young adults, the idea of saving and investing for the future is easier said than done.

It is a challenge to contemplate retirement when you are young and your focus is on starting a career rather than ending one. However, saving and investing, as with most things in life, works best with an early start. There are several key benefits from investing early versus waiting, such as compound interest, time and risk, and experience.

There is an urban legend that Albert Einstein once said, “Compounding interest is the most powerful force in the universe.” Compound interest is simply defined as interest being earned on interest. Knowledgeable investors put this practice to work and understand the longer money is put to work, the more wealth it will generate in the future. That is why the magic of compounding works best the younger you are when you start. The two ingredients for compounding to be effective are the reinvestment of earnings and time.

In addition, the length of time a person has to invest increases the amount of risk they are able to withstand. Younger people with many productive earning years ahead of them can afford to take more risk with their investments. Others that are approaching retirement may drift toward less volatile investments. A long investment time horizon enables good years in the market to balance out the bad ones, which allows market returns to come closer to their long-term averages. Therefore, while the passage of time does not eliminate the relationship between volatility and return, it does lower the impact of volatility.

Though young adults have the advantage of time, most usually lack access to investment capital.

Since they have to get by with less money, learning to invest in the early years gives them the ability to develop disciplined spending habits. These habits will help them in the long run; they will become accustomed to paying themselves first before paying others. For example, they will prioritize contributing to their company-sponsored retirement plans or IRAs before spending their hard earned money on the latest gadgets.

Although we can read and learn about investing from books or the internet, the best learning comes through experience. Since investing has a protracted learning curve, young adults are at an advantage because they have years to study the market and refine their strategies in order to avoid investment pitfalls. The experience gained from investing early will play a large part in future investment success.

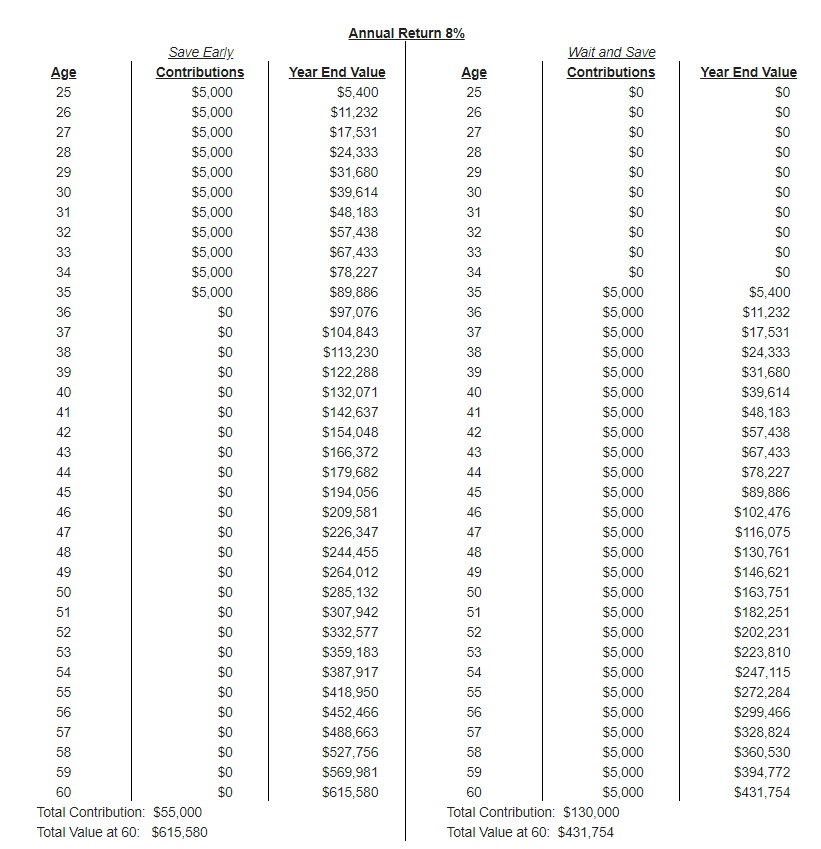

The illustrated investment model demonstrates the power of investing early as well as compounding. It compares two 25 year olds that have the same goal of retiring at age 60. However, they differ in their savings and investment approach. They both earn an 8% annual rate of return on their investments. The early saver invested $5,000 a year for 10 years, from age 25 to 35.

At age 60, her portfolio value was just over $615,000 with a total investment of $55,000. The “wait and save” person decided not to save for the first 10 years. Instead, he saved $5,000 a year for 25 years, from age 35 to 60. At age 60, he accumulated just over $430,000 with a total investment of $130,000. Even though the later saver invested more than double the amount of money than the early saver, he ended up with $183,000 less at age 60.

You, our clients, are living examples of the benefits of saving and investing. Pass your good habits to your kids and grandkids.

Article from the Provident Investment Management blog

Dan Krstevski, CFP®, Director of Development and Client Services, Provident Investment Management

He works with asset custodians on behalf of clients to make financial transactions easy and prompt.