How do I use the Preferred Procedure in SSGPlus?

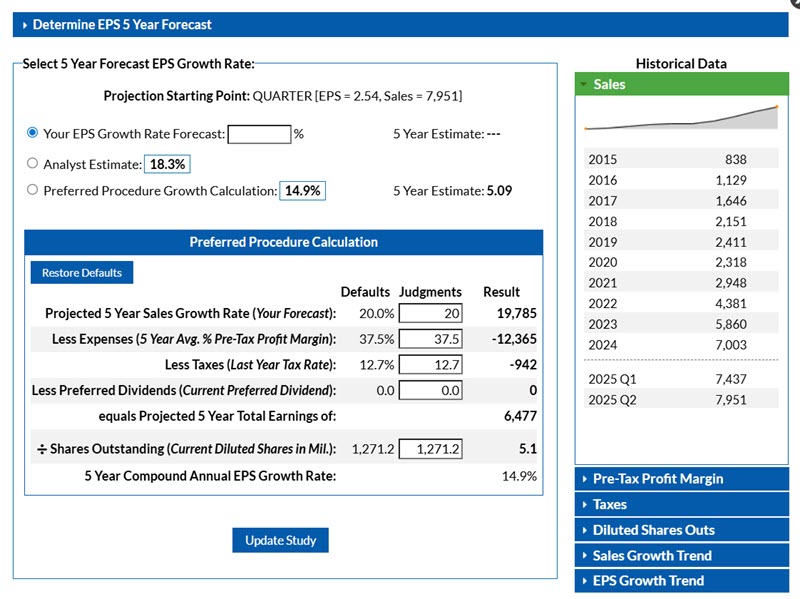

The Preferred Procedure in SSGPlus is a step-by-step method to project a company’s future Earnings Per Share (EPS) by starting with sales growth and logically connecting it to future profitability. It serves as a second opinion on your EPS forecast and helps you better understand how the company’s business model drives earnings.

Accessing the Preferred Procedure in SSGPlus

-

Open your company study in SSGPlus.

-

On the Visual Analysis page, click in the Earnings Per Share (EPS) Growth Rate box.

-

This opens the EPS Forecast window, where you’ll see the option to use the Preferred Procedure

How the Preferred Procedure Works

The tool builds a projected five-year income statement by applying your estimates to several factors:

-

Sales Growth Rate – Begins with your forecast for future revenue.

-

Pre-Tax Profit Margin – The percentage of sales left after expenses, before taxes.

-

Tax Rate – Usually based on the company’s recent effective tax rate.

-

Preferred Dividends – Rare; use the default if applicable.

-

Shares Outstanding – The expected number of common shares in five years.

SSGPlus provides default values for each item (e.g., five-year average margin, last year’s tax rate, current shares outstanding). You can accept or adjust these defaults based on research, recent trends, or external sources such as Value Line or Morningstar.

Why Use the Preferred Procedure?

-

Improves understanding of how a company makes money by connecting sales to profits.

-

Adds confidence to your EPS forecast by testing assumptions.

-

Reduces reliance on analyst estimates by creating your own logical forecast.

-

Encourages judgment: For example, you might adjust a margin downward if costs are rising, or raise share count if a company regularly issues new stock.

Remember:

-

EPS growth should generally not exceed sales growth over long periods.

-

Forecasts higher than history require solid reasoning.

-

The Preferred Procedure is most useful for high-quality companies with steady financial histories. It is less effective for highly cyclical or inconsistent businesses.

Tips for Better Results

-

Review historical trends in margins, taxes, and shares to guide estimates.

-

Check company filings (10-K, 10-Q), press releases, and management commentary for context.

-

Compare your results with analyst ranges and Member Sentiment data for reasonableness.

-

Use the Notes feature in SSGPlus to record your rationale for future reference.

For more details, see: