BetterInvesting’s four core principles transformed bleeding edge investment techniques of the 1920s and 1930s into simple maxims accessible to anyone willing to do research and be patient.

A Review of BetterInvesting’s 4 Principles

By:April 14, 2023

BETTERINVESTING’S CORE PRINCIPLES

- Invest a set amount of money regularly. Do so regardless of the swings in the market. This will help you maintain a lower and more favorable average cost per share of stock.

- Reinvest all earnings. By reinvesting all your dividends and profits from the sale of stock, you’ll fully leverage the power of compounding.

- Buy stock in high-quality growth companies. Search for growth companies that increase earnings consistently over time.

- Diversify your portfolio. Spreading your stock investments over a number of different companies of differing sizes and industries will help reduce the risk of being in the stock market.

The kernel of BetterInvesting’s four core principles is a list of three principles that were quoted to good effect by co-founder George Nicholson, a Harvard-educated securities analyst to members of the budding Mutual Investment Club of Detroit. The club, including the two other National Association of Investment Clubs co-founders, Tom O’Hara and Fred Russell, made its first stock purchase in 1940. The original three principles were:

- Invest regularly, without trying to guess which way the market is going.

- Make money on money by not taking out interest or dividends and letting it compound.

- Invest only in companies that seem to offer the potential to double in value every five years.

By 1951, the investment clubs Nicholson mentored formed the National Association of Investment Clubs, today’s National Association of Investors, commonly known as BetterInvesting. Somewhere in its journey from 1951 to 2001, when the organization’s history was published in a book, BetterInvesting had rewritten its principles and tagged on a fourth.

— Editor’s note, information from The NAIC News and “Main Street Millionaires” by Mike Wendland.

BetterInvesting’s four core principles transformed bleeding edge investment techniques of the 1920s and 1930s into simple maxims accessible to anyone willing to do research and be patient. The principles owe a debt to famed investors Benjamin Graham and David Dodd. To give some idea of Graham and Dodd’s influence, famed investor Warren Buffett studied under Graham at Columbia University. He continues to apply Graham’s focus on value today.

Ready to Enhance Your Investing Skills?

Get free essential insights to advance your investment journey.

Access the Quickstart PDFGraham rejected chart reading, which was becoming increasingly popular at the time, saying that it could never be a science. Instead, he promoted managing risk through diversification and selecting stocks according to both numerical and qualitative factors that evaluate stock primarily as ownership in a company. Instead of merely buying stock and hoping it will go up because it has in the past, Graham was concerned about buying the most future cash flow he could get at the lowest possible price.

Though the field of stock analysis has evolved drastically over the years —some might even say it’s come full circle from the 1940s, BetterInvesting’s principles have stayed consistent because they’ve proven successful for millions of investors. In this 70th anniversary year, let’s review these four principles and how they contribute to stock market success.

Why We Invest a Set Amount Regularly and Reinvest All Earnings

The process of building wealth divides into two phases. The first phase is when the growth in your portfolio comes from your savings. The second — and much more fun — part comes from when the portfolio gains come the benefits of compounding. As your principal grows, the market gains on your portfolio will hopefully dwarf your regular contributions. Then those gains start compounding. Your profits make more profits.

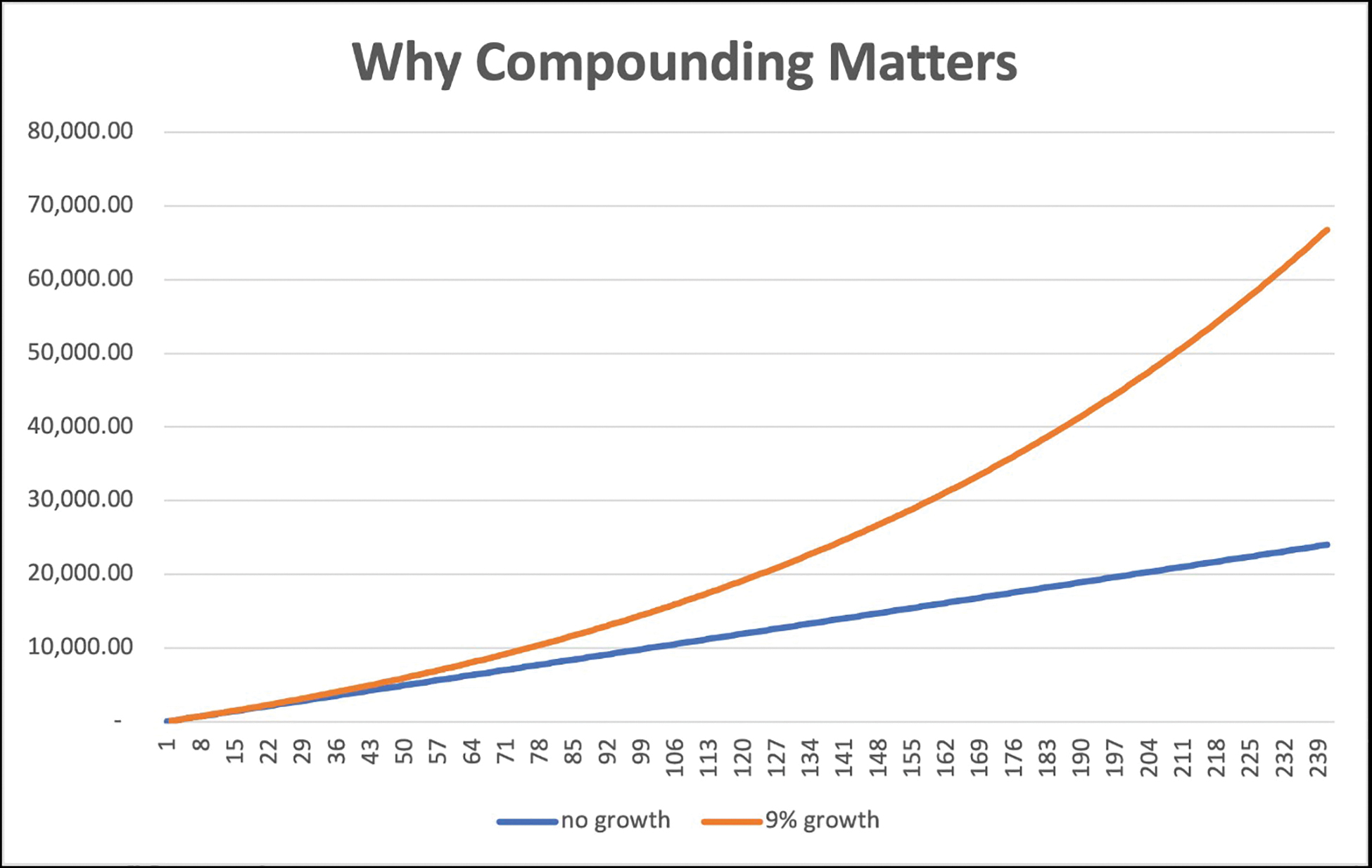

It’s hard to understate the benefits of compounding. At right is a graph thatcompares saving $100 a month for 20 years with no growth against doing the same saving with 9% growth, a reasonable expectation for the S&P 500’s long-term performance.

If you’re starting from scratch, there’s no way around the need to save. You need to build enough savings to see meaningful growth from your portfolio.

By establishing a predictable investing schedule, you’ll find it easier to stick to the plan long enough to reap the rewards of compounding gains.

Another reason BetterInvesting encourages disciplined investing comes from how it smooths the impact of down markets. You want to buy low. When the market declines, you will get more stock for the set amount you invest. If the market is high, you’ll buy fewer shares. That’s called “dollar-cost averaging.” Aside from being financially sound, it’s a morale booster that kicks in right when you might need it the most. It would be fun to take profits out of the account occasionally. But we reinvest earnings because it would be a shame to deny our dollars the chance to make even more money. But wait! That’s not all.

We understand that even if the long-term trend is up, market gains can and do temporarily reverse themselves. Market survival means making sure those reversals stay temporary. When we take out all our gains, losses will erode our original savings to zero. Reinvesting profits builds that safety net.

Ready to Enhance Your Investing Skills?

Get free essential insights to advance your investment journey.

Access the Quickstart PDFWhy We Buy Stock in High Quality Growth Companies

There are as many ways to invest in stocks as there are investors. You could look for stocks trading below their asset values. You could buy stocks with high price momentum. Maybe you believe the economy will accelerate or decelerate and you wantstocks that will do well under that condition.

BetterInvesting stresses buying solid companies with the ability to consistently grow profits. Yes, we want to buy them at a low price but, above all, we want that growth and quality. But why? With all the investment philosophies to choose from, what makes quality growth better than, say, deep value or momentum investing?

The answer comes from who we are. Most of us aren’t paid to stare at stock screens all day. We’re busy building our careers or raising our families. We look forward to our monthly club meetings, but we have plenty of other priorities too. So, once we’ve done all the research and made the decision to buy a stock, we want to hold it for as long as possible.

Not just for a few months or even a few years. We hope to hold on to a stock forever. It’s challenging enough to find a few great buy candidates without having to constantly replace them. If the company is on a path to continued growth, we prefer to hold onto it. When we aren’t confident in a stock’s growth potential, we look to replace it.

Since we’re not trying to time the market or trade for pennies, we needcompanies that we believe can survive downturns in the economy and the occasional business misstep. That requires financial resources. We look at the debt ratio to ensure the company isn’t overleveraged and then we examine profit growth for reassurance that the company has cash flow to continue to grow and build shareholder wealth. BetterInvesting’s greatest asset is its members, but the Stock Selection Guide comes in a close second for the structured analysis it offers.

But we won’t stop with a few ratios. We consider the attractiveness of theproducts and services our target companies offer, the industries they compete in and the strengths or weaknesses of management teams. We compare the target companies to their competitors. We read the financial filings, in particular the management discussions and analyses that tell us what keeps a company’s CEO awake in the middle of night.

Price Still Matters

We love quality, and we adore growing profits. But we still don’t want to overpay for a stock. Buying the right company at the wrong price might mean years of waiting for the company’s performance to catch up to what we paid. Luckily, the SSG’s method of assessing risk and reward helps us spot when a great stock is priced at a reasonable entry point or when one of our stocks has become so overvalued that it’s time to harvest profits and move on to the next opportunity.

Ready to Enhance Your Investing Skills?

Get free essential insights to advance your investment journey.

Access the Quickstart PDFWhy We Diversify

It’s hard to find stocks that meet all our criteria but holding only one or a couple of stocks is accepting unnecessary risk. We can be diligent in our research and right about why we bought a stock, but its price can still decline. We also must be realistic about how accurate we can be looking into the future.

Stocks react to different economic and business factors. Cyclical stocks, such as auto companies, do better when disposable income is increasing and interest rates are low. Defensive stocks outperform the rest of the market when the economy is expected to decline. Health care stocks may be driven by government policy or, Heaven forbid, another health crisis.

We could attempt to shift between different sectors to capitalize on our perceptions about the economy, but studies show it’s difficult to be right often enough to justify the effort. And we’d rather focus our limited time and efforts toward investing in companies we believe in, regardless of where we are in the economic cycle.

Owning a portfolio of several stocks in different industries reduces the risk of being wrong and being so wrong that our wealth won’t ever recover. Diversifying to smooth portfolio returns helps us remain confident in our long-term expectations and stick it out through inevitable challenges.

We know that staying fully invested is the surest route to long-term stock market success and we want to make it as easy as possible without accepting lower returns than what stocks can provide.

Consistency Is Our Secret Formula

We follow these principles because they have proven their worth to several generations of investors and give club members a common framework to evaluate stocks. They also follow established financial theory.

We understand there are different ways to invest and may even utilize additional tools in our investment decisions beyond the SSG.

But we try not to follow investment fads or switch strategies midstream, because we’ve seen enough people get whipsawed chasing strategies. We would rather miss out some of the time than risk missing out all the time by being late to every party.

Is it boring to always follow these rules? Wouldn’t it be more fun to be “creative” or maybe it would be easier

to invest according to a hunch? Maybe. But there are plenty of other ways for us to be creative. When it comes to investing our hard-earned money, we’d rather do it right.

This article was originally published in the October 2021 issue of BetterInvesting Magazine.