From Your Mattress to the Money Market, Your Options for Cash Reviewed.

Finding a Safe Place for an Emergency Fund

By:July 15, 2021

Up until recently, when we thought of emergencies, we thought of personal emergencies: home repairs, being fired, medical treatment not covered by insurance or covering high deductibles. For many people, a true market crash had receded from memory. None of us ever expects a downturn in circumstances.

For many years now I’ve cautioned clients that we don’t know when an emergency will hit, but that inevitably, emergencies will happen. While each emergency (or market downturn) has unique reasons, they all result in a need for money, immediately, often at the same time that investments and employment are taking a strong plunge. Yet, most of us hate to keep substantial funds in cash — the cash is trash slogan. Sure, it’s made almost no return for many years; on the other hand, in times when the markets are tanking, it’s stable.

Over the long run, it’s a mistake to fore go the returns of the market, but in the very short run, you need enough to cover costs so that you don’t need to make panicked decisions based on immediate volatility.

While how much cash to keep is always based on personal circumstances, you can start from three rules of thumb: three months’ worth of necessary expenses if there are two earners in the household or you have significant non employment income; six months if you’re single or only one household member is working; and two years’ worth of expenses not covered by Social Security or pensions, if you’re retired. The two critical components of a location for an emergency fund are that it must be safe and it must be very easy to access.

What are your options?

Your Mattress

It may seem like the ultimate emergency solution to keep actual cash in your home. Safe? Not necessarily. You can be burglarized, experience a fire, a tree can fall on your home or you might have light-fingered guests. In a sudden emergency your loved ones may not be able to locate your hide hole. (One of my relatives used to stick bills in books. Many books were donated before that was discovered.) In our now increasingly cashless society, a credit card can probably tide you over until you can get money from an account. The amount you should have for emergencies is probably too substantial to keep at home.Verdict: not safe, but easy to access if you remember where it is.

Gold and Gems

While gold coins hidden under floorboards kept some people alive during World War II in Europe, it’s very hard to realize their true value in an emergency. Who can make change? If you hold bars or gems, you must store them somewhere and pay for it, as well as having verification of worth. These storage sites might be very difficult to access in a cataclysmic emergency. While it’s true that gold shares and gold-focused mutual funds generally skyrocket in bad times, this is a countercyclical investment choice rather than an emergency reserve, and generally pays nothing unless sold. Bonds and bond funds, which also have yield, would probably be a better choice.Verdict: risky and not easy to access.

Brick and Mortar Banks

In your checking account, you can access money at any time via ATMs, even when you’re out of the country. You might consider keeping one month’s savings in a savings account, to cover the time it might take to get money from another account, but these banks currently pay almost nothing. However, your money is insured up to $250,000 per depositor.Verdict: safe and easy access.

Internet Banks

Online banks have been paying higher interest than physical banks, because they have far lower costs to reach and serve the consumer. But those interest rates are subject to change so it’s important to monitor current rates. You should know whether they are FDIC insured or not; most well-known ones are. As always, if the rate is too good to be true, it is.Finally, it can take several days to process your request and get money into your checking account. This is not ideal if you need actual cash immediately, but is probably swift enough to beat the deadline on your credit card.

Verdict: safe (if insured) and moderate access.

Money Market Funds

Some banks will offer money market funds and even a cash bonus, especially for a large initial deposit. But these are not necessarily insured and the interest rate is not guaranteed. Money market funds are the standard settlement account at investment companies. Be careful you know exactly what your money might earn: Some so-called cash management accounts are just funds held by the brokerage.Money market mutual funds generally are not insured and the interest rate can vary depending on markets for short-term money, although they are very low in recent memory. These funds often have a check-writing capacity, albeit with a high minimum amount. Usually you can’t set up automatic bill pay, e.g., for your mortgage or student loan.

Usually these funds invest in short-term government securities and sometimes corporate paper. While the funds are not insured, their investments are generally in safe and easily liquid instruments, so they should be able to pay off with little risk. If you’re especially concerned, you can choose a money market fund that invests only in government securities. If you’re in a very high tax bracket, you can find tax-managed funds, but with short-term interest rates so low, these are rarely worthwhile.

Verdict: low risk if the fund invests in government securities and you’re with a big company that might be “too big to fail.”

Access: moderate (write a check or electronic transfer).

Short-Term Bond Funds

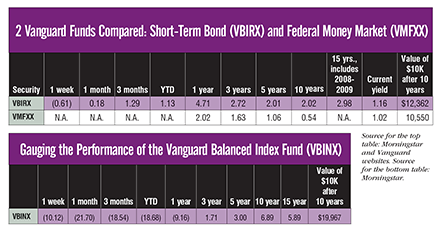

Short-term bond funds can be invested in any short-term instrument, for example, one to three year government bonds, including non-U.S. governments, corporate, or mortgage-backed notes. Before choosing a fund that promises high yield, investigate what it’s invested in. While the share price of these funds can vary, they generally swing very little, depending on interest rates. As with all bond funds, when interest rates go up, share prices fall but yields rise. With money market funds, the share price stays totally steady, at $1, but the yield can also be very small, as in the Vanguard Federal Money Market Fund (ticker: VMMFX) yields.Usually I advocate evaluating mutual funds on their long-term performance, but in this case, we’re looking at a parking place for the short term, and we want these funds to hold onto value in just about any market condition, so let’s look at short term performance, as of March 23. Remember, this is total return, including any capital gains plus yield.

The near-term results for VMFXX are essentially meaningless, because the share price won’t vary (no capital gains returns), and the yield is 1.02% — the only return. For near-term fluctuations, VMFXX is the steadier choice, but over every time period of one year or more, the short-term bond fund total return is nearly twice or more the return of the money market. Short-term bond funds do fluctuate with market conditions, but very little: The standard deviation for the Vanguard Short-Term Bond (ticker: VBIRX) is 1.49. The S&P 500 is currently 13.25.

Which should you choose? If you need every penny to be available and anticipate needing the money in a year or less, a money market will virtually guarantee it. If, however, the prescribed emergency fund is a substantial amount, you could consider dividing it into money you always need to have at your fingertips, and money you may or may not need in the foreseeable future. You’re taking a little more risk to be rewarded with a little more money.

Verdict: low risk but higher than insured accounts or stable share price funds.

Access: Short-term bond fund shares must be sold to convert to cash. Once placed in your settlement account, you can either write a check or use electronic transfer, so it can take several business days.

Balanced or Blended Funds

Much as I like balanced funds as an easy solution to many investment situations, they are not a good solution for emergency funds for many people. Their value can vary greatly with market conditions. For example, the standard deviation of the Vanguard Balanced Index (VBINX) is 7.82, nowhere near as volatile as the S&P 500, but certainly not a short-term cash investment (see second graphic above). Why even consider such a fund?Let’s say you earn $200,000, and you establish that your emergency fund should be $75,000. But let’s also say you have a job in an essential industry or service, your boss loves you, there’s no takeover or restructuring in sight and you have great disability insurance. At the same time, you’re pained at the thought of making less than 2% on that much money. You might be willing to take the risk of investing half that emergency fund in a balanced fund, with a good chance that you won’t need it and enough risk tolerance that you’d be willing to take a loss. Take a look at how VBINX

has performed over time (see the table above).

Is it worth it to you to earn about $5,000 more for each $10,000 invested? If your emergency fund remains parked for at least five years, you’ll have done better with the balanced fund. If, however, you do have an emergency that requires withdrawal before five years, you would have been better off with the choices above.

Verdict: Balanced funds carry fairly high short-term risk but good return over the long term.

Access: requires selling the shares and transferring to your settlement fund, a similar amount of time for any mutual fund.

Caveats

Many mutual funds require a minimum initial deposit of $3,000 or more. Below that amount, they can close you out. But they’ll generally keep at least money market and settlement funds open, no matter how much is in them. If you go with an online option, set up automatic transfers. Waiting for the mail can be agonizing.As with every investment, the more risk you take, the more reward might be there. For emergency funds, treat them not so much as an investment, but as a cash repository for immediate needs. As we now know, that can be a worldwide emergency with very little notice.

This article was originally published in the June/July 2020 issue of BetterInvesting Magazine.

Danielle L. Schultz, CFP, CDFA, is a fee only financial adviser with Haven Financial Solutions, Inc., based in Evanston, Illinois. She’s the author of “Idiot’s Guide: Beginning Investing.”