Your Personal Circumstances Will Determine the Best Time to File for Social Security Benefits.

Social Security Basics With a Twist

By:November 1, 2020

One of the most frequent questions asked by our clients is when to claim Social Security retirement benefits. We wish we could tell you there’s one ideal age at which to start receiving Social Security, but it really depends on your circumstances.

To help you make the decision that’s right for you, we’ll review the rules for taking Social Security, give you some examples of how the timing of when you start taking benefits can make a big difference and look at a strategy for couples that’s only available to those born before 1954.

When Can I Start Receiving Social Security?

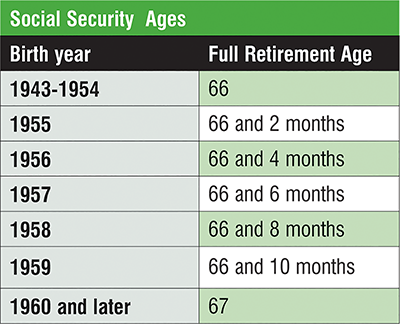

Your full retirement age (FRA) is the age at which you can receive unreduced benefits. For those born after 1943 but

before 1954, your FRA is age 66. For those born between 1955 and 1960, the FRA starts at 66 years and two months, and increases by two months each birth year to 1960. For those born in 1960 or later, the full retirement age is 67.

You have the option of claiming retirement benefits as early as age 62, but your benefits will be reduced for each month under full retirement age and the reduction can be as high as 30%. For example, a person eligible to receive $1,000 per month this year at age 66 would have received only $750 per month if she decided to start receiving benefits at age 62.

If you’re married, your spouse is eligible for a spousal benefit of 50% of your benefit. If your spouse’s own benefit would be higher, your spouse will automatically receive his or her own benefit instead with one exception, which we cover at the end of this article. Here again, you can receive spousal benefits as early as age 62, but the payment will be reduced from the full spousal benefit available at full retirement age.

To review your estimated benefits, full retirement age and earnings each year, you must set up an account with the Social Security Administration and access the report online at www.ssa.gov/myaccount.

What Factors Should I Consider in Deciding When to Receive Social Security?

Based on average life expectancies, a lower benefit paid for a longer time will add up to the same as a higher amount paid over a shorter period. So why not take benefits as soon as possible?

Most people don’t die at the average life expectancy, so you have to consider your expected longevity based on your family history and your own health. You may end up receiving Social Security income for a lot longer than you think.

Once you know the amounts that would be paid to you at 62, at your full retirement age and at age 70, you can compute your break-even point to determine how long you’d have to live for delaying benefits to make sense. This is the point at which the cumulative amount of benefits you receive if you delay benefits equals the cumulative amount paid to you if you started receiving them earlier.

It’s important to know that when you claim early benefits, they’re permanently reduced. There’s no increase when you reach your full retirement age. But if you need the income at 62, you may not have the luxury of opting to wait for the higher benefits.

If you took benefits early but then want to change your mind, you can do so within the first 12 months. This would then allow you to avoid the reduction to your benefit from claiming early and to claim your full benefit at FRA. To make the change, you must submit Form SSA-521 and repay any benefits you have received to date.

Is There a Reduction in Social Security Income if You’re Still Working?

If you’re still working at age 62, your benefits will be further reduced if you earn over a certain amount each year. If you continue to work between the ages of 62 and your full retirement age, you forfeit $1 of Social Security benefits for each $2 your earnings exceed $17,640 in 2019. This figure is indexed annually for inflation and is different in the year you reach FRA.

For example, let’s say Anna retires from her full-time job at age 62 and is eligible for $1,200 per month from Social Security. She expects to earn $23,640 for work she does in 2019. This means that if she were to claim Social Security benefits, they’d be reduced by $250 per month:

$21,480 – $17,640 =

$6,000 in excess earnings

divided by 2 =

$3,000 per year, or

$250 per month

Note that once you reach your FRA, there’s no reduction in benefits if you continue working.

What’s the Benefit to Me if I Wait Past FRA to Collect Social Security Income? Another piece of the Social Security puzzle is the delayed-retirement credit.If you wait until after your full retirement age to apply for benefits, you’ll receive a credit that boosts your income. The credit is applied for every month you delay past FRA at the noncompounded rate of two-thirds of 1% per month, or 8% per year.

There’s no incentive to delay benefits past age 70, since the delayed-retirement credit won’t apply after you’ve reached that date. So we’ve narrowed down the Social Security decision to somewhere between ages 62 and 70. That’s still a wide range, but based on how long you expect to live, your need for additional income or your plans to continue working after age 62, you may already be starting to get an idea of what makes sense for you.

Spousal benefits are not eligible for delayed credits in the same manner. Spousal benefits are limited to 50% of the other spouse’s income at full retirement age.

Delayed Credits — An Example

Let’s assume we have a married couple named Ted and Lisa, who are both age 66 and thus have reached full retirement age this year. Ted is eligible for a Social Security benefit of $2,000 per month, or $24,000 per year, based on his career earnings. Lisa is also eligible for a benefit of $24,000 per year, based on her own career earnings.

If both began their benefits this year, they would receive a total of $48,000 per year. If both wait until age 70, they would each be eligible for an increased benefit of $31,680 per year, or $63,360 total. But they would have given up the $48,000 per year between age 66 and 70, a total of $192,000.

To make up the for the four years of income they skipped between age 66 and 70, they would each need to live past age 82. This is their break-even point. If Ted and Lisa live past 82, they will receive more total dollars from Social Security by waiting and earning delayed credits. If one or both should pass away before age 82, they would have been better off taking benefits at age 66. In addition to the 8% each year increase, the benefits may also increase because of inflation.

As you can see, there’s some guess-work involved in choosing the best strategy, as none of us know how long we’ll live!

Restricted Spousal Benefits — Expiring Soon!

Before 2016, a number of loopholes allowed married couples to further strategize in various ways to maximize each other’s benefits. Most of those loopholes were closed by legislation passed in Congress in 2015. But a married couple can still take advantage of what is known as a restricted application, provided they were born before Jan. 2, 1954. Under this strategy, one spouse files a “restricted application for spousal benefits.” This means that they’re filing for only 50% of their spouse’s benefit, not their own. Their own benefit will then continue earning delayed credits until age 70.

Let’s return to our previous example of Ted and Lisa. Under the restricted spousal benefit strategy, Lisa will file for full benefits at age 66, or $24,000 per year. Ted will file a restricted application for spousal benefits, which allows him to receive half of Lisa’s benefit ($12,000) and allows his own benefit to continue to grow to age 70.

At age 70, Ted files for his own benefit, which has now grown to $31,680 per year thanks to delayed credits.

Under this scenario, Ted and Lisawill receive $36,000 per year between age 66 and 70. From age 70 on,with Ted’s increased benefit, they will receive $55,680 per year.

Thus, this strategy pays them $144,000 between age 66 and 70, which they would not have received had they both delayed. And it pays Ted an additional $7,680 per year from age 70 onward, which he would not have received if they both filed at age 66. Under this scenario, Ted and Lisa’s break-even point would be age 88.

In a perfect world, where both spouses live happily into their 90s, delaying benefits will always work out best. Filing early, filing at full retirement age or filing a restricted spousal benefit strategy are all tools you can use to help guard against the impact of an untimely death.

The Future of Social Security

A report released earlier this year stated that the Social Security trust fund is expected to be depleted in

2034. We expect changes will be made so that the funds won’t run out, though they may not happen soon. The proposed solutions include increasing the FICA (Federal Insurance Contributions Act) taxes workers pay, increasing the amount of benefits subject to taxation, reducing the cost-of-living increases and increasing the retirement age.

Similar changes were made when we faced this predicament in 1983. Congress and President Reagan reached a bipartisan agreement to increase the retirement age and amount that was taxed.

This article was originally published in the October 2019 issue of BetterInvesting Magazine.

Alexandra Armstrong is a CERTIFIED FINANCIAL PLANNER professional and Chartered Retirement Planning Counselor and chairman and founder of Armstrong, Fleming & Moore, Inc., a registered investment advisory firm

Christopher Rivers, a CERTIFIED FINANCIAL PLANNER professional and Chartered Retirement Planning Counselor and co-author of this article is a principal of Armstrong, Fleming & Moore, Inc. Securities are

offered through Commonwealth Financial Network, member FINRA/SIPC.

Investment advisory services are offered through Armstrong, Fleming & Moore Inc., an SEC-registered investment adviser not affiliated with Commonwealth Financial Network.

Consult your personal financial adviser before making any decisions. Ms. Armstrong can’t answer individual inquiries, but welcomes suggestions for future article topics.

This material has been provided for general informational purposes only and doesn’t constitute either tax or legal advice.

Investors should consult a tax or legal professional regarding their individual situation. Examples are hypothetical and for illustrative purposes only. No specific investments were used in the examples. Actual results will vary.