Equity Compensation Is Great, But Calls for Careful Money Management

Company Stock Grants and Your Taxes

By:January 16, 2023

Equity compensation can seemingly come out of nowhere. One day, you’re earning a base salary and bonus, the next (often after a promotion or job change), comes a new added form ofcompensation: company stock. The most common form of equity compensation today is restricted stock units, often referredto as RSUs.

RSUs pose many different questions over and abovethat cash bonus you receive: How do they work? How are they taxed? What do I do with them?

A company grants restricted stock. This can be done as a one-time event or as part of an annual compensation plan. The grant is generally based on a dollar amount, which is then equated to a specific number of shares. For example: On grant date, the company promised you $40,000 in shares of XYZ Inc. If, on grant date, company XYZ trades as $25 per share, you earned 1,600 shares.

No tax is owed … yet. You do not technically own the shares until they “vest.” The vesting of your RSUs occurs on specific dates set to a predetermined schedule. Vesting schedules vary from company to company, however, there are two main forms worth noting.

The first and most simple is the “cliff vest,” in which thewhole grant vests on a specific date. A three-year cliff vest would mean that all 1,600 shares vest three years from the original grant date.

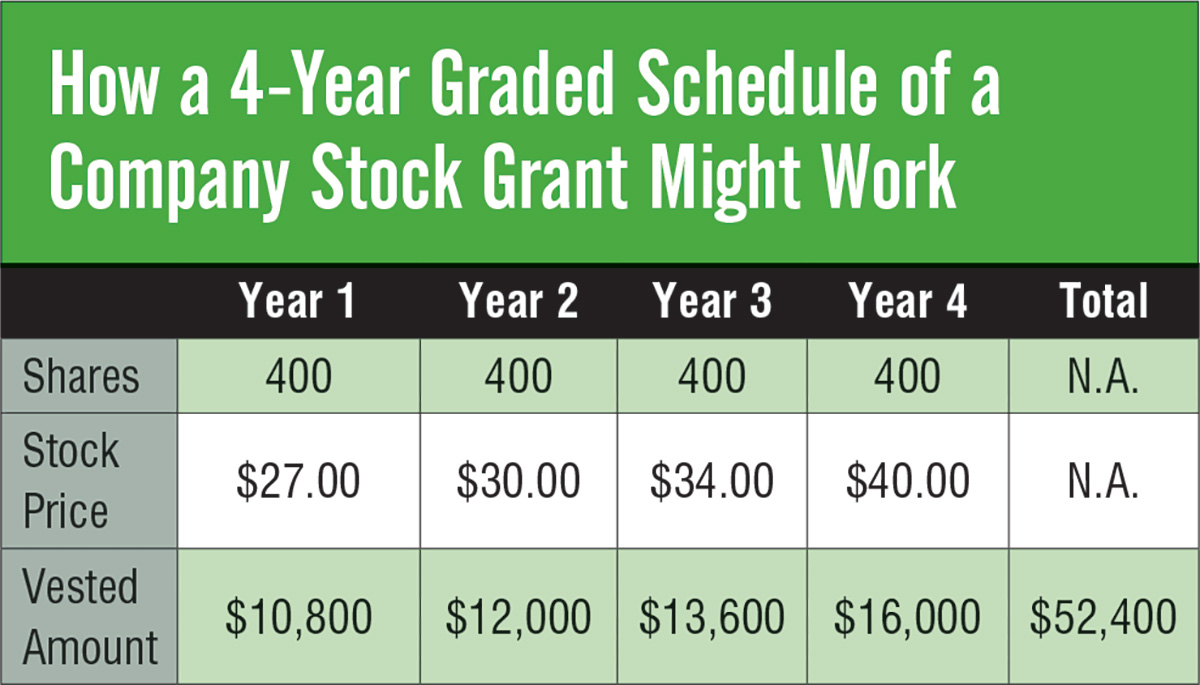

The second and more common type of vesting is a “graded schedule.” Graded schedules differ from company to company, but the principle of the RSU vesting in tranches over some predetermined period is the core issue.

The graphic below is a look at what a grant would look like with a four-year vesting schedule:

Vesting dates are important, that is when the shares areearned and when taxes are first owed. Taxation at vesting is treated as if the vested amount is ordinary income. Often, the company will withhold shares for tax (generally 25%) and at the vesting date, shares, net of tax, will be deposited into a brokerage account.

Using “Year 1” in the table at right, 100 shares arewithheld for federal income tax and 300 shares are deposited into a brokerage account with a value of $8,100. That $8,100 is the cost basis in the stock and from that point any future sale in the stock will be taxed at capital gains rates, which are dependent on the holding period.

If grants are being awarded on an annual basis, the cascade of vesting tranches can lead to significant additional ordinary income. This leads to a very important tax consideration. The company may automatically withhold 25%for federal tax, but if your effective rate is greater than25% you may be looking at a tax bill come April, which isoften a surprise for those new to equity compensation.

With the general knowledge of how RSUs work and are taxed the next logical question is: What do I do with them? What you should do is treat them as compensation and integrate the stock into your greater financial plan. When planning, you rarely consider components in isolation.

RSUs play a considerable role in wealth accumulation and their handling often requires a tailor-made approach dependent on a variety of variables.

Failing to plan can leave an employee over-concentrated in company stock, which while this could have considerable upside, can also leave that employee exposed and under-diversified.

Handling an equity compensation requires expertise and as Benjamin Franklin said, “If you fail to plan, you are planning to fail.”

Matt Mondoux sits on the investment committee and is anadviser at Blue Chip Partners, Inc., a privately owned, registered investment advisory firm based in Farmington Hills, Michigan.

This article was originally published in the December 2021 issue of BetterInvesting Magazine.